Still Planning For 2023 Savings Goals? Do It With Maya!

I've been an avid user of Maya ever since the year it started and its old name, PayMaya. When late this year they announced the Maya Savings Account, I got excited and luckily, I was able to open a Savings Account with 4.5% Savings Interest rate. Indeed, Maya is true to its tagline "everything and a bank" which is for sure very useful for every Young Filipino out there.

It's almost the end of the year and we should ask ourselves and do some financial review, how much savings did we make for this year? Is saving your money physically on a piggy bank enough? Is saving your money in a "low-savings interest rate" bank-wise to do? There are a lot of questions that come into our mind which in the end made us scared to invest or save our money in the right bank.

But mind you, this year is so far the best on my Savings Account and thanks to Maya Bank. And Of course, I am still putting a lot of money into my Maya Bank. Here's my New Year's Action Plan for my Savings Bank!

WALLET. I am still saving a specific number of money in my wallet because I am using it for my digital purchases and mobile payment transactions. With the latest QR Codes, we can use them for every transaction to wherever and whatever you are trying to buy or services. In addition, money transfers to Maya accounts are free of charge, so this is really the e-wallet to be.

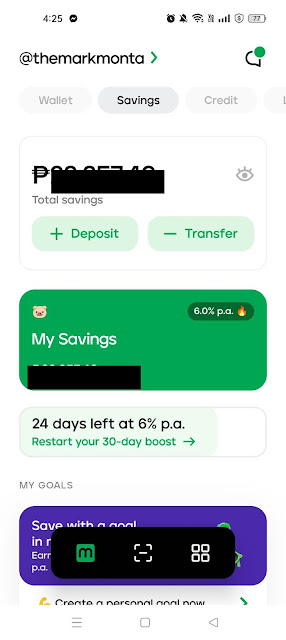

SAVINGS. Yes, you read this right. Maya has Savings Account. With an interest of 6.0% Per Annum, you can actually maximize your savings put in Maya Savings Account. As of now, with my 5 Digits money, I already earned the right amount of money. This is one feature I am so proud of!

CREDIT. This part is still under review but next year, I am planning to open a Credit card using my Maya Account. Heads up, you know what? Based on your savings account, Maya will calculate on how much money they can let you borrow using your Credit Card so it's safe and you can surely know that you can pay on time. What other features?

- Up to PHP 15,000 credit limit

- Low Service fee based on credit used within the billing period

- No additional documents are needed.

LOANS. Did I not say Everything and a bank? Yes, Maya has the LOANS feature!!! Personally, I haven't used this yet but this is interesting as you can pay in 4 easy installments every 2 weeks at your favorite shops!

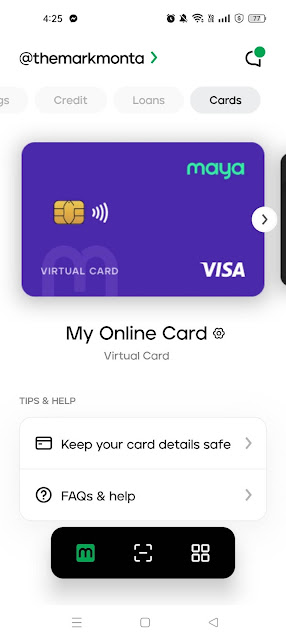

CARDS. This part is another good feature that I am so proud of! Because I have my own virtual Maya Card and of course, just recently, I received my Physical Card with my customized Username in it. If you are worried how will you use these? Based on experience, you can actually link these two cards with your own Maya Account and you can use them accordingly while monitoring the INs and OUTs of your money using Maya App. Virtual Cards are for online purchases while Physical cards are for some groceries and shopping at malls or supermarkets.

|

| Here's my Physical Card with Personalized Username |

Here are some reasons why you should leap forward into a new banking experience with Maya:

Seamless and integrated experience. Maya is not just a zero-interest-earning e-wallet now. You can make your money work harder with its savings feature. Conveniently move your money to your e-wallet to make a transaction and buy or sell crypto. What's great about this is it's all seamless, as digital banking is integrated into the app. No need to deal with another bank or app and submit new requirements.

Daily savings interest crediting. Most recently, Maya introduced a daily interest crediting in its savings feature. Yes, you read it right - you can see your up to 6% per annum earnings daily in your Maya Savings transaction history - not monthly!

More rewarding daily transactions. Maya is also pioneering mission-led rewards to encourage customers to save and use digital for everyday transactions. Starting October 15, you'll earn an already high base rate of 4.5% interest per annum on your savings, credited daily. You can quickly increase this to 6% in the next 30 days by paying with Maya for your everyday transactions. Simply spend at least P250 when paying for your purchases via Maya QR, card, or mobile number or settling your bills via the Maya app. This offer is available until January 31, 2023. Stay tuned for more updates on your savings interest!

Personalized Goals to manage your money. Maya offers an efficient way to manage your money with its Personal Goals feature. You can create up to five goals with set target amounts and timelines for organized tracking, on top of a high-yield 6% interest rate available until December 31, 2022. Soon, daily interest rate crediting will also be available for this feature.

Easy account opening and transfers. Accessing Maya Savings is easy – you only need an upgraded Maya wallet account. Once you have your Maya Savings account, you do not need to worry about maintaining a minimum balance. Fund transfers to other banks and financial institutions via PesoNet are also free until December 31, 2022.

Create your credit history. Every transaction you make in the Maya app, including Savings, can help you build your credit score. Maya offers eligible customers an instant revolving credit of up to PHP15,000, which you can use in your wallet or transfer to your Maya Savings.

Reliable and secure. Rounding up the top-of-the-line features is Maya's record of reliability and safety. The Maya app enjoys a 99.94% app uptime rate. Its digital banking services are powered by Bangko Sentral ng Pilipinas (BSP)-licensed Maya Bank, and deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) for up to PHP 500,000.00 per depositor.

Maya is more than just Maya, visit maya.ph or follow @mayaiseverything on Facebook, IG, Tiktok, and YouTube and @mayaofficialph on Twitter. Join our Telegram community at https://t.me/TeamMayaPH

0 comments

Show some Love, post a comment please? <3 <3 <3